Telco + AI Japanese chip equipment sales have been upgraded and has a high history

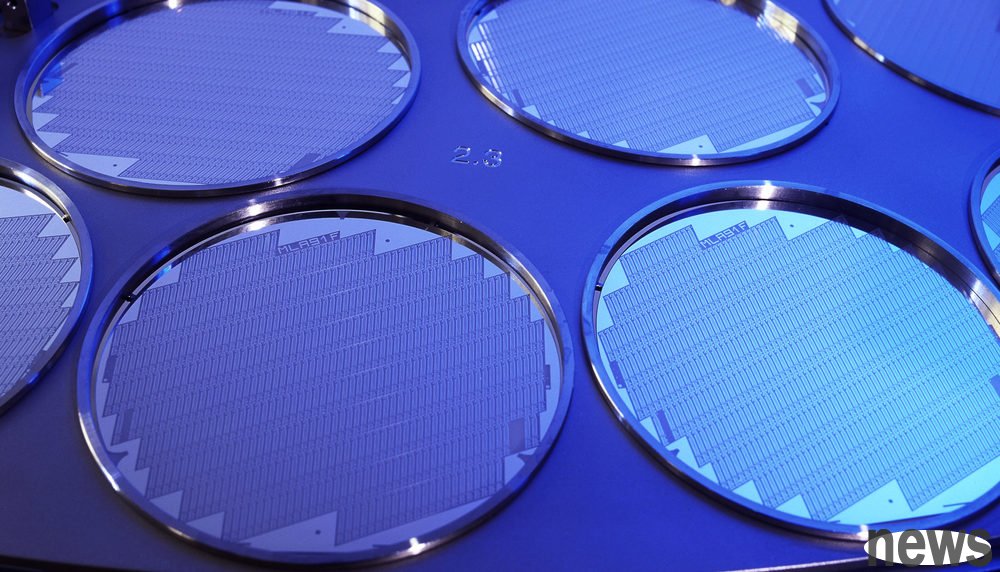

Intensive demand for GPUs and HBMs for AI servers, coupled with the benefit of Taiwan Power's production of 2 nanometers (nm), the Japan Semiconductor Manufacturing Devices Association (SEAJ) revised the 2025 Japanese semiconductor (chip) equipment sales estimate and will continue to record highs, and the 2026 annual sales estimate will exceed 5 million Japanese cyclical links for the first time in history.

SEAJ The estimated report was released on the 3rd, pointing out that due to the strong demand for GPUs and HBMs for AI servers, Taiwan's advanced crystalline foundry factory (Taiwan Power) will increase its investment in starting production of 2 nanometers and 2 nanometers, and the increase in investment in DRAM/HBMs in South Korea, so 2025 (April 2025-2026 3 Month) Japan's chip equipment sales amount (referring to the sales amount of Japanese companies' domestic and overseas equipment sales amounts of Japanese companies) has been revised up to 4863.4 billion yen from the previous estimate of 4659 billion yen (January 2025), which will increase by 2.0% compared with 2024. The annual sales amount will set a record high for the second year. Sales volume in 2024 increased by 29.0% to 4.768.1 billion yen, breaking through 4.4 trillion yen for the first time in history and setting a record high.

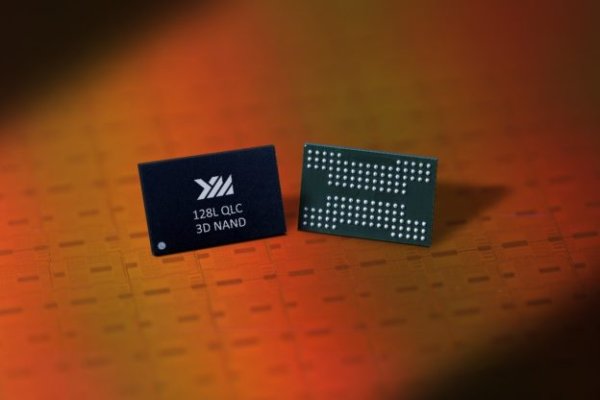

SEAJ said that during the 2026 (April 2026-March 2027), companies outside Taiwan will increase their investment in 2 nanometers, and we expect Japan to make quantitative investment in 2 nanometers, plus manufacturers use HBM and NAND for AI servers. Investment in Flash (products above 300 layers) is expected to increase, so Japan's chip equipment sales in 2026 will be revised up from the previous estimate of 500 million 124.9 billion yen, which will increase by 10.0% year-on-year. The annual sales will break through the 50 million yen for the first time in history and continue to set a record high.

Regarding the situation in 2027 (April 2027-March 2028), SEAJ pointed out that in addition to the demand for AI servers, products that are expected to be equipped with edge AI in the smartphone/PC field will account for nearly half of the world's share, and Japanese chip equipment sales are expected to increase by 3.0% year-on-year to 5.510.3 billion yen, and annual sales are expected to reach record highs in the fourth year.

(Source: SEAJ)

The average annual compound synthesis rate (CAGR) of Japanese chip equipment sales during the 2025-2027 period is estimated to be 4.9%. Japan's chip equipment global market share (calculated by sales) reaches 30%, ranking second in the world only in the United States.

Extended reading: Japanese chip equipment sales continue to be strong and have the second highest history. Related stocks are in full swing AI Wang WSTS reviews global semiconductor sales estimates and has a high historical record