China Changjiang has managed to seize the world NAND Flash market accounts for 15%, building national equipment lines to avoid US sanctions

After being included in the physical list by the US Department of Commerce at the end of 2022, Chinese NAND Flash manufacturer Changjiang Cash has been unable to obtain American advanced crystal manufacturing equipment, but the company has not stopped because of this. Tom's Hardware quoted market news and pointed out that Changjiang Cash not only plans to increase its monthly production to 130,000 films by the end of 2024, but also plans to challenge 15% of the global NAND Flash production by the end of 2026. In addition, Changjiang Cunjian is promoting a national equipment test production line, becoming one of the ways to avoid US sanctions.

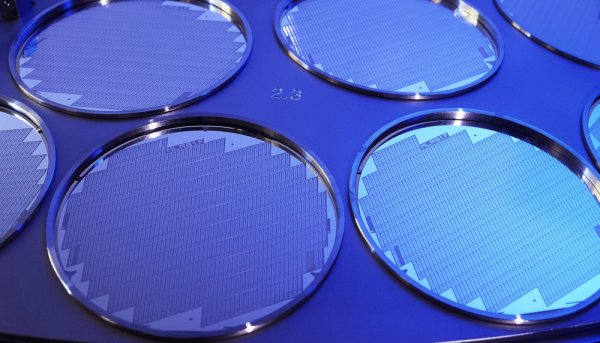

Changjiang Cash will achieve monthly production capacity of about 130,000 films by the end of 2024, and is expected to increase production to 150,000 films by 2025, which will be approximately 8% of the global NAND Flash supply. This growth is mainly due to the official investment of its fifth-generation 3D TLC NAND (X4-9070). The product uses a 294-layer stacking architecture, with a significantly improved bit density and an interface speed of 3600 MT/s. Even though Changjiang Cun has limited ability to obtain new equipment from international equipment suppliers such as ASML, Applied Materials, and KLA, it still plans to introduce self-developed technology and domestic equipment on a large scale, supporting its cell growth rate is far higher than 10% to 15% of the overall market.

In order to redeem foreign equipment, Changjiang Cunyuan has begun to build a test line that uses only Chinese crystalline factory tools, and is expected to start trial production in the second half of 2025. This is a countermeasure after the export of stacking technology equipment above 128-layer stacking, and is also an important trial for the independence of chip equipment in China. According to the analysis of the market analyst, once the test line is successful, it will help Changjiang store expand its modulus production possibility and advance towards 100% equipment domestic production. Market evaluation, if Changjiang Stocking can increase monthly production to 200,000 films, it will have the right to influence the global NAND Flash price trend.

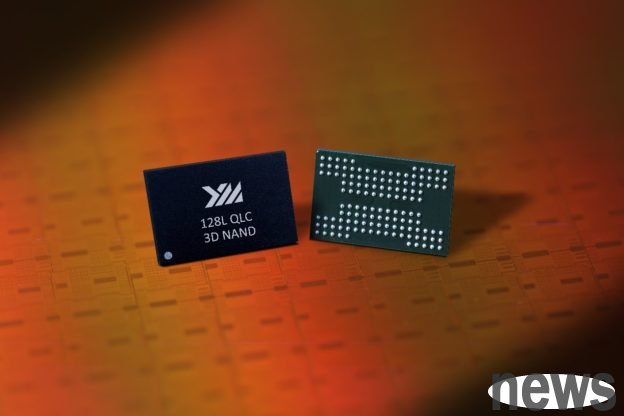

In terms of product routes, except for 1TB X4-9070, Changjiang Cun will launch the 3D QLC X4-6080 later in 2025, which may continue to stack 294 layers to produce 2TB 3D TLC X5-9080 and 3D QLC X5-6080 by 2026, which will support 4,800MT/s high-speed interfaces. The next generation architecture is expected to exceed 300 layers of stacking, thereby increasing the bit output of each wafer, and maintaining overall output growth even if the process time increases and the number of monthly shots decreases.

The US regulations in 2022 prohibit US companies from exporting equipment that can manufacture 3D NAND Flash with 128 layers of stacking to China, but Changjiang Cunyuan successfully used "stack stacking technology". It is still uncertified that the company has obtained new American equipment since the ban, but it still maintains the development and manufacturing of advanced NAND Flash product lines based on existing tools.

In addition, Changjiang Cun invests in local Chinese equipment and material suppliers through its "Changjiang Capital" and avoids external supervision, including requiring cooperative manufacturers to remove trademarks from equipment to avoid potential sanctions. According to the report of Morgan Stanley, the current domestic equipment utilization rate of Changjiang Inventors is as high as 45%, far higher than the average of 15% to 27%. Suppliers include China Microelectronics (CVD), Northern Huacai, Paotech and other Chinese equipment manufacturers with first-line standards. However, China is currently unable to manufacture advanced exposure machines and become a mass-produced bottle head. Although Changjiang Inventor has advanced processing and large-scale investment capabilities, the yield and stability of local equipment are still the main reasons to limit the scale of its test line.

Looking ahead, Changjiang Cunyuan expects to reach a 15% market share of the global NAND Flash market by 2026, and the Chinese domestic demand market exceeds 30%. However, the test line is still in the early stages, and whether it can increase volume smoothly and the production volume is not yet clear. There are still challenges in terms of yield, production costs and technical reliability. Despite this, Changjiang Inventory's rapid expansion, equipment domesticization and capital investment strategies have become one of the most representative enterprises in China's semiconductor independent industry.