ASML warns that uncertain sustain growth in 2026, negative news hit stock prices and fell by more than 7%

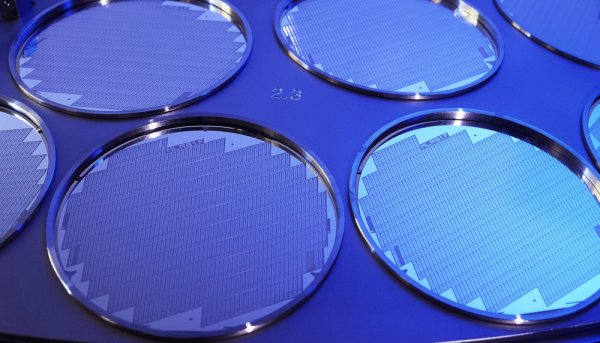

Semiconductor equipment manufacturer ASML announced its financial report on the 16th, exceeding the expectations of market analysts, but warned of future growth, mainly due to increasingly tight ground politics and environmental uncertainty, especially tax responsibilities. Despite strong demand for artificial intelligence (AI), companies still need to be cautious about dealing with multiple challenges, ASML said.

ASML performed well in the second quarter, with a 23% harvest of 7.7 billion euros, a net order amount of 5.5 billion euros, and a net profit of 2.3 billion euros, both exceeding analyst estimates. However, the seemingly strong financial reports have not dispelled the market's worries. ASML Executive Christophe Fouquet said that macroeconomic and geopolitical factors, including taxation, have led to increased inconsistencies, and that goals cannot be identified at this stage even as they are still preparing for growth in 2026. Affected by this, ASML stock price fell by nearly 7%.

ASML also released its third quarter outlook when publishing its financial report, with net revenue ranging from 7.4 billion to 7.9 billion euros, slightly lower than market expectations, and gross profit margin of 50% to 52%. The main reason for the continued growth of the third quarter is that the booming development of artificial intelligence is promoting strong demand for ASML semiconductor equipment. Among them, GPU manufacturer NVIDIA (NVIDIA) has recently become the world's first company to have a market value of more than $4 trillion. With the US ban on wide chip exports to China, this will also help NVIDIA's operations and thus have a positive impact on ASML. NVIDIA recently announced that it will resume selling its H20 AI chips in China after the U.S. government relaxes export restrictions, which is a transfer machine for NVIDIA and also shows potential improvements in trade relations.

However, not all customers are in a hurry. ASML's two major customers, Intel and Samsung, are suffering from financial backlash. Among them, Samsung recently announced its first financial report on its profit decline in the past two years. Market analysts pointed out that Intel and Samsung's dilemma, as well as the inconsistency in memory capital spending, may have an impact on ASML.

Although semiconductors are currently temporarily immune to the U.S. tax, it is still unknown whether chip manufacturing equipment can also receive the same exemption. One of the main challenges facing ASML is that the possible impact of US taxes and potential retaliatory taxes is still unclear. In addition, the Dutch government has imposed restrictions on the export of certain advanced products to China, and currently there is no sign that these measures will be lifted. Therefore, the macroeconomic environment and tax-related impacts quoted by ASML are more likely to be uncertainties stemming from the Chinese market.

Generally speaking, ASML is in a period of time full of opportunities and challenges. The huge demand brought by AI is an important force for its growth, but the political tensions in the ground, tax threats, and the financial difficulties of some customers have cast a layer of uncertainty on its future. Whether the company can effectively respond to these external factors will be the key to achieving the 2026 growth target.