Memory price increases are coming, ADATA s EPS in the first three quarters is 10.08 yuan, exceeding the full year of 2024

Benefiting from the strong rise in memory prices in September, ADATA's consolidated revenue in the third quarter of 2025 increased by 13.15% compared with the second quarter, an increase of 54.38% compared with the same period in 2024, and the amount reached 14.5 billion yuan. Gross profit margin increased by nearly 4 percentage points from the second quarter to 22.7%. Net profit after tax was 1.862 billion yuan, an increase of 1.9 times compared with the same period in 2024, and an increase of 106.82% compared with the second quarter. Net profit attributable to the parent company was 1.76 billion yuan, which tripled from the same period in 2024 and doubled from the second quarter. EPS per share was 5.57 yuan.

Cumulative, 2025 The combined revenue in the first three quarters reached 37.243 billion yuan, an increase of 22.8% compared with the same period in 2024, the average gross profit margin was 19.04%, the operating profit was 3.559 billion yuan, the net profit after tax was 3.316 billion yuan, an increase of 34.16% compared with the same period in 2024, the net profit attributable to the parent company was 3.165 billion yuan, an increase of 31.66% compared with the same period in 2024, and the EPS per share reached 10.08 yuan.

ADATA stated that in the third quarter, it not only set four new highs in single-quarter operating gross profit, operating profit, pre-tax net profit, and after-tax net profit, but also rewrote historical records with pre-tax net profit margin and after-tax net profit margin at 17.64% and 12.83% respectively. Under the halo of the four Grand Slam profits in a single quarter, the cumulative pre-tax net profit in the first three quarters was 4.601 billion yuan and the after-tax net profit was 3.316 billion yuan, which also significantly exceeded the full-year performance in 2024, setting a new annual profit record in advance! EPS exceeded 10 yuan in the first three quarters. In the third quarter, EPS increased by nearly 200% year-on-year to 5.57 yuan, exceeding the total in the first half of the year.

ADATA said that rigid demand from the world's large cloud service providers continued to push up the memory market. In addition to DRAM contract prices rising more than expected in the fourth quarter, NAND Flash prices also soared. As seen so far, the supply of DRAM and HBM from upstream original manufacturers in 2026 has been fully booked, and NAND and HDD have also fully entered the seller's market. There is no turning back from the increase in memory prices.

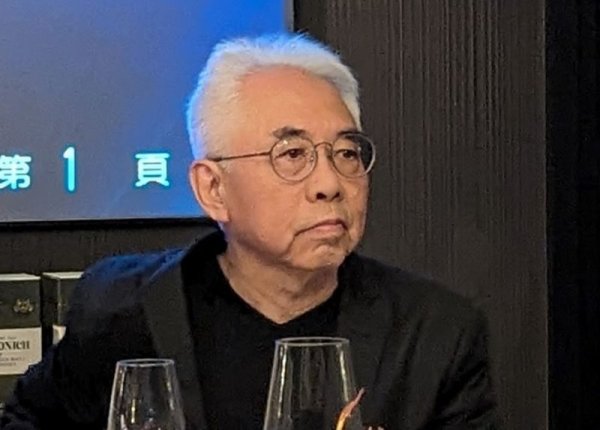

ADATA emphasized that in the fourth quarter, the company can only support the needs of strategic and major customers and make every effort to increase operating profits. Not only is it optimistic about a new high in gross profit margin, but the full-year revenue target is also sprinting to a record high of more than 50 billion yuan. In terms of inventory, we are actively responding, with the goal of raising the inventory level to more than 20 billion yuan. Under the dual strategy of increasing profit margins and inventory levels, the company's operating results in the fourth quarter will show leapfrog growth. Looking forward to the profit trend in the fourth quarter and 2026, ADATA Chairman Chen Libai is full of confidence in continued growth. The company's revenue and gross profit margin increased significantly in the third quarter, which also drove profits in the third quarter and the first three quarters to set the highest record for the same period in history!